Do You Know Your Credit Score?

It is understandable that most people do not have the time or energy to pay attention to their credit score. Kids, activities, and a 40+ hour work week are your top priorities, and your credit score is way down the list.

While this is completely understandable, the small amount of effort it takes to know your credit score, and taking the steps necessary to improving it, can really pay off.

While nowhere near historical highs, mortgage interest rates over the past 3-4 years have been higher than in the previous number of years. But most experts believe that is about to change. Rates today are lower than they’ve been in 10 months, and setting aside a short period of time last September, rates are lower than they’ve been in almost three years. And most expect the Fed to begin to lower the discount rate in the next a couple weeks, which is more good news for mortgage rates.

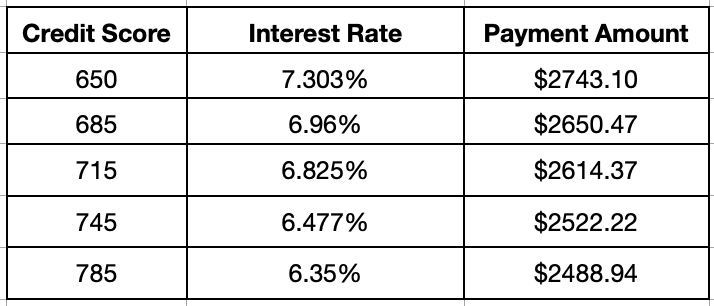

So what about your credit score? If you or someone you know purchased a home in the past 3-4 years, you may be a candidate to refinance over the next six months to lower your payment and possibly remove PMI. If you are in that group, now is the time to check your credit score and do what you can to improve it. Below is a sample chart to show the impact your credit score has on your interest rate and your monthly payment amount.

These numbers are for illustration purposes only. Loan amount is $400,000 with 20% equity. Payment Amount is principal & interest only.

The difference between a 650 score and a 785 is nearly 1%, and the monthly savings is over $250 per month. That is how impactful your credit score is on your interest rate.

In our next newsletter, I will give you some simple ideas you can take now to raise your credit score and put more money back in your pocket after a refinance.